This post is an in-depth review of the Taxbot Review product. I have personally used this product for over 3 years.

What Is Taxbot?

Taxes can be a polarizing subject. And some people are deathly afraid of them.

NOTE: Taxbot was aquired by Hurdlr. Hurdlr is an improvement on the Taxbot app. Download Hurdlr here.

Taxbot has focused on their tax training programs for entrepreneurs. I'm a big fan of what I have learned from them, and I think as an entrepreneur, you need to be educated and not rely exclusively on your accountant. My former accountant cost me tens of thousands of dollars…but that's another story.

If you want to educated yourself on how to maximize tax deductions, check out Midas IQ (from the Taxbot folks.). Confused about how to calculate crypto taxes? Try this.

How Much Can Taxbot Actually Save You?

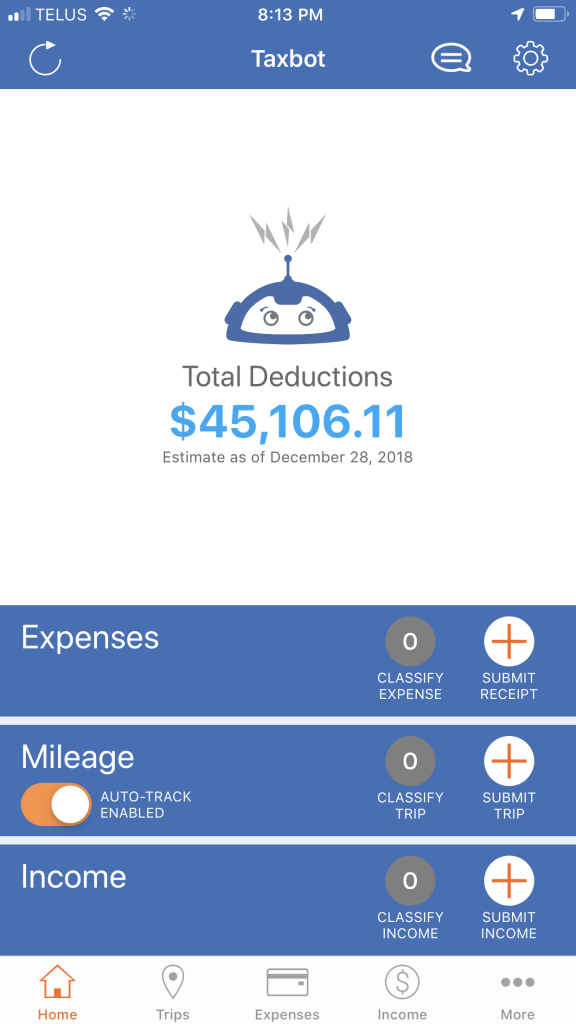

It totally depends on your business. But for me, Taxbot saved me $45,106.11 in deductions I would have missed otherwise in 2018:

Now keep in mind that if I were in a 50% tax bracket, this would have saved me about $20,100 in real money. Obviously, tax brackets are a complicated subject, so this is would vary based on your individual financial circumstances.

I know taxes are not everyone's favourite subject… but like death, it's something everyone has to deal with. So anything that can make you tax time easier is worth learning a little more about, don't you agree?

Many people have “fear” around audits and the IRS/tax regulations. I'll explain how Taxbot will give you peace of mind (as it did for me) about your taxes a little later in this blog post.

But it's your legal right to be able to deduct your taxes as much as possible as long as the deductions are real and valid. Taxbot helps you record and capture deductions that otherwise would be missed. And that will save you money.

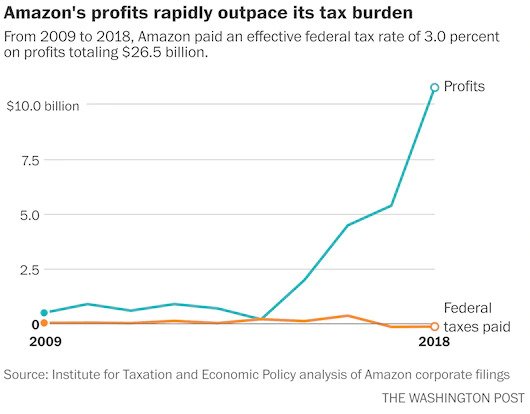

Look, when mega-corporations like Amazon and Exon-Mobil pay zero in taxes, you should certainly get all the tax breaks you are entitled to by law.

That's crazy, right?

Note: Taxbot works in the US, but it also works for any country. For myself, as a Canadian taxpayer, I have used it to get many more deductions than I would have without using it. This post will show you how.

Taxbot Webinar:

I have a free video training that explains how I use to maximize my business deductions. You can watch that video here.

Who Created Taxbot?

Taxbot was created by Sandy Botkin and Jake Randall. I'll get into who they are a little later in this post.

So how does Taxbot accomplish the goal of helping you pay significantly less in taxes?

Well, there are 2 main parts to the Taxbot product.

There is the mileage/deductions portion, which focuses on claiming business trips and expenses as legitimate business expenses, and there is the accounting portion where you can create year-end books for your accountant in a matter of minutes.

Additionally, there are some optional videos which legal tax expert and Taxbot co-founder Sandy Botkin teaches some strategy on how to reduce taxes for entrepreneur and business owners. I've been through the videos and learned quite a bit, but you don't need them to use Taxbot and have Taxbot start reducing your tax burden immediately. Sandy Botkin, who actually worked for the IRS, has also written some books on tax strategies.

Let's talk about mileage deductions first.

What I Wish Somebody Told Me About Mileage Deductions Before I Started My Own Business

For many small business owners and entrepreneurs (and this includes just about anybody in Network Marketing or even just doing a side-hustle), which could be mowing lawns, managing rental properties, or doing some sporadic graphic design work on Fiverr, or managing somebody's Pinterest Marketing account – or whatever! Literally anything you bill for with your online invoicing software.

The #1 biggest missed deduction for small entrepreneurs is automobile expenses.

The reason why is that it's a huge pain in the ass to document your mileage and calculate how much of your automobile car payments, gas, and repairs and maintenance can be counted towards your deductions.

This is not going to be a problem for you anymore, because of Taxbot.

So what the Taxbot app does, is once you allow it permissions to do so, it tracks when you start moving in a car (based on the speed it can tell if you are in a car.) I find it has been very accurate. It drops a geolocation pin from your starting point (which is often your home) and when you stop for more than 5 minutes, it drops an end of trip pin.

So it measures the actual miles (or kilometers in Canada) you have driven.

You simply swipe left if the trip is personal. And swipe right if the trip is business. And instantly, it tracks what percentage of your travel is tax-deductible for your business.

So you don't need to record starting and ending mileage. You just need to track your year-beginning Odometer reading.

SIDE NOTE: I started in June 2017, so for my first year, I recorded my beginning mileage on July 1st, recorded the mileage for the rest of the year, and had my accountant double it to account for the months Jan-June that I was not using the app. This is perfectly fine. You can track as little as a 3-month span in the year and extrapolate your yearly mileage deductions based on that number.

Why I like Taxbot Recording My Trips

First, it's automatic.

Second, it gets me oriented to thinking about how I can make a trip tax-deductible.

Third. I would never do this with consistency is I was using a pen and paper notepad instead of using Taxbot.

Some Taxbot Tips From A Pro User

Now the nice thing is that you can merge trips together, which I often do for the sake of clarity and brevity.

So, for example, if I am driving to the bank to do deposit a business check, for example, but I stop into the grocery store on the way back home, I'll merge the whole trip back into just one trip – from bank to home.

My main business purpose was to go to the bank, so I would have had to driven home anyhow. But my grocery trip now becomes tax-deductible because it was on the same route as a business trip.

So now my entire tripe becomes a legitimate, audit-proof, tax-deductible business expense.

That saves me real money…every time I leave the house.

How Taxbot Guide You

Taxbot prompts you to record the necessary pieces of information the tax people would want to know. And in the case of meals and/or entertainment expenses, it will ask you WHO you were meeting at the meal and WHAT the purpose of the meal is about.

(Asked for referral) is the default answer, which is a valid answer provided you generate some business from some of these meetings during the calendar year.

What I love about it, and I've been personally using Taxbot for over 3 years now is that it tracks all of my trips, so I can just easily categorize these when I'm home and in my downtime.

Honestly, I always knew I could write off a portion of my automobile and gas expenses as a small business owner, but it was too burdensome to manually record the odometer after every stop. I never could remember to record that no matter how hard I tried.

Now, I get to maximize all of my business-related trips, so I can easily give a report to my accountant that documents the total mileage for each calendar month and the km (or miles) traveled for business and for personal in each of those time periods.

From that, my accountant can calculate the percentage of deductions. Done and dusted.

But I want to stress that it's good to plan your trips around business trips – even if it's just picking up batteries for my apple headphones at the mall. (Yes, that is a valid business deduction as I use my phone to make business calls.)

Keep in mind you're not just writing off a portion of your gas. you also write off a portion of your car insurance, a portion of your repairs and maintenance, your tires, and your car/lease payment.

so you can see it can quickly become highly beneficial to identify trips as business travel.

Now the rule for the IRS is as long as it's reasonable and properly documented, they are not going to give you a problem. They are not looking for perfection. They are looking for crooks.

I have been audited in a field audit before by the Canada Revenue Agency (the Canadian equivalent of the IRS) – not for my mileage, but I know how the audit process works. As long as you can justify any expense, you shouldn't have a problem deducting it. There may be certain cases where they might disallow certain deduction you feel are related to your business but these should be negligible – especially if your records are well documented.

The key to peace of mind with your taxes is keeping it all up to date and organized… and Taxbot helps you do that. Also, the fact that your records are well-documented – and Taxbot is the best at that. This means that tax time becomes less stressful and certainly less time-consuming.

Even if you didn't save money, Taxbot would be worth it for that alone. (But trust me, you'll save a very significant sum.)

Having your taxes documented like Taxbot prepares them for you, will give you great confidence in dealing with any financial situation that may arise.

Taxbot and Bank Feeds

Taxbot can also connect to your bank feeds and pull all the income and expenses into Taxbot and then you can categorize it in Taxbot according to per-determined IRS-approved categories.

You can also make your own categories.

I, personally, don't use the Taxbot feature because I am Canadian and my business is mostly in USD, which is a bit more complicated – so I do my full accounting on Wave Accounting, which is built for non-accountants.

Now, it's not that I don't like syncing banks with a central online portal. I do think this gives you a good overview of your finances. I use Mint.com to get a quick overview of all my bank accounts across multiple banks and investment houses.

I do like using Wealth Simple, and Wealthica, both of which are available for Canadians. You can see my video review of Wealth Simple on YouTube.

Cloud-Based Bookkeeping Systems

Sidenote: If you want a great free accounting system, I recommend Wave. Moving to cloud-based books is awesome. I have a bookkeeper in the Philippines, so I don't need to bother my accountant for unimportant things. And I have a local Canadian accountant who does the final accounting stuff for me.

I first moved to Xero, which was cloud-based, but is very accountant-speak. I found Wave much easier for the entrepreneur who does not have a formal accounting background. I also tried Zoho Books, which was not as intuitive as Wave, but easier to grasp for non-accountants than Xero.

if I had a simple business or a one currency business, I would do my entire books in Taxbot – because it's so easy. You can generate profit and loss reports directly from the TaxBot back office.

From the web-based back office, you can also add any trip data that is missing – like let's say you had your phone turned off – just add it the starting and ending locations by address and it will calculate the mileage for you!

You can also take one trip and toggle a button to make it a “round trip” which would double the trip and calculate the return leg. sometimes I prefer to do this if I had many stops on the way home – or if I went out of my way on a personal detour.

Adding Business Expenses In Taxbot Manually

Instead of having Taxbot sync with my bank, I take a picture of business receipts and Taxbot prompts me to add the relevant details, and it also stores a photo of the receipt so I don't need to keep the paper one.

Of course, you can also do this from the back office, and upload receipts as pictures or PDFs.

This is really nice because it saves space and sanity at tax time.

Tracking Multiple Businesses With Taxbot

Taxbot allows me to track multiple automobiles and multiple businesses.

Now I only have one care, because neither my wife nor myself work outside the house. So we don't really need a second car.

But being able to track multiple businesses, but keep them isolated is exactly what the tax people want to see. Nothing irks the tax people more than co-mingling finances.

For example, I have a rental property. So I have a separate business set up as a rental property. So any travel I do related to this business, I assign that trip to the rental property business. Any expenses I incur as a result of this business, I add to Taxbot under that business as well.

So if I have to pick up some supplies at the hardware store, I keep the receipt, snap a picture, and Taxbot tracks all of my expenses for that business. (It also tracks the income for you if you add that. Income does not require a receipt to add it into Taxbot.

Taxbot As An Estate Tracker Tool

Taxbot is also an incredible estate tool. I wish iI knew about it when I first become an executor.

You can easily track your time, your mileage, and any expenses directly through the app and keep it separate and easily prepare a report for the courts or your lawyers.

Remember, executors often rely on this at the end – even if you have started being an executor without Taxbot, I would encourage you to start tracking everything about your executor “job” from day one so you can prove what you did later if it ever comes to that. (Believe me, these things that start out where everyone agrees often end with everyone fighting and disputing things you never thought you would be disputing, That's the nature of estates.

Taxbot Reviews

Taxbot has some strong reviews in the App Store. Keep in mind that a high rating like this is good, particularly for a free app that has a paid subscription model. Most of the 1 Star reviews are people complaining that they actually have to pay for continued functionality with the app. But trust me, it's worth it!

How much does Taxbot cost?

Taxbot, when I bought it cost me 9.95/mo. I pay for a year at a time for about $100 for the year.

Also.. that $100 is tax-deductible. but it saves me so much more in missed deductions and lost receipts – it easily saves me several tens of thousands of dollars each year.

Honestly, I don't know why anybody would not use it. it just makes sense.

So that's my Taxbot review. I hope you learned a few things from it that will save you money on your next tax return.

You can signup for Hurdlr here.

If you don't see how this can save you thousands of dollars each and every year, you need to read this post again. 😉 Or you can sign up for my webinar where I show you how I use Taxbot personally.

You can register for the free Taxbot webinar here.

(You'll learn some tips on reducing your taxes as an entrepreneur that I didn't cover in this blog post also on the webinar.)

Hey, I'm Andrew. I moved to Lisbon, Portugal from Canada. Follow my journey here.

I also happen to run a SAAS that helps marketers give their shared links superpowers. You can create a free account and start being more productive: Check out Linkalytics here.

I'm passionate about AI and using AI tools to help creators and marketers create better content, faster. Get the jump on AI and discover free AI tools every week.

Read my writings on Medium.

Got a marketing question? Need some direction? Book a call with me.